What Is Real Estate Disclosure Automation (and Why It Matters Now)?

Real estate disclosure automation means your required notices are delivered at the right moment, acknowledged, time-stamped, and stored—without manual effort. Instead of juggling paper forms or hoping agents remember every step, automation ensures consistent delivery, creates verifiable audit trails, and protects you when questions arise. In a market where consumer protection and fair housing oversight are tightening, automation isn’t a luxury—it’s the safest, simplest path to compliance.

The Risks of Manual Processes (Missed Steps, Fines, and Lost Trust)

Open houses are fast and messy. Paper forms go missing. Visitors skip a signature. The wrong version of a notice gets handed out. Any one of these can trigger delays, disputes, or penalties—plus reputational damage that outlasts the commission. With real estate disclosure automation, you remove the guesswork: the system delivers the correct version every time and logs exactly what was seen, when, and by whom.

How RLTRsync Builds Real Estate Disclosure Automation into Your Open Houses

RLTRsync’s Entry Point Pro open house platform pairs digital sign-in, lead capture, and disclosures in a single flow. Visitors scan and sign in; required notices appear instantly; acknowledgements are recorded and time-stamped; documents and activity are stored securely. It’s real estate disclosure automation that scales from solo agents to multi-office brokerages.

11 Effortless, Powerful Ways to Stay Compliant with Real Estate Disclosure Automation

1) Present required notices automatically at sign-in. Eliminate paper handouts and “we forgot” moments by surfacing agency and fair housing notices in the sign-in flow.

2) Time-stamp every interaction. Automation records date, time, property, and visitor—building a court-ready trail without extra steps.

3) Lock the latest, approved language. Central templates ensure the current, broker-approved wording is always used, preventing outdated PDFs from circulating.

4) Tie disclosures to property and visitor records. Each acknowledgement is linked to the specific open house and contact, so the trail follows the lead if they become a client.

5) Require acknowledgement before proceeding. Hard stops prevent visitors from skipping disclosures and ensure consistent compliance.

6) Auto-save to a centralized, searchable archive. Retrieve proof in seconds for a client, broker, auditor, or attorney—no hunting through email.

7) Broker-level oversight and alerts. Admins see which events completed disclosures and receive alerts for exceptions to fix issues fast.

8) Version control with audit history. When rules change, update the template once; the system preserves historical versions and who saw what.

9) Exportable compliance reports. One-click reports summarize who received which disclosures and when—ideal for audits or dispute resolution.

10) Staff and team onboarding in minutes. Pre-configured flows enforce standards across teams and offices, reducing training time and variability.

11) Pair with modern lead capture. With RLTRsync you don’t trade speed for safety—disclosures happen while you collect complete contact data and segment follow-up.

Compliance Benchmarks and Resources You Should Bookmark

Keep your team’s training aligned with authoritative guidance. Start with the U.S. Department of Housing and Urban Development’s overview: HUD Fair Housing Act Overview. New York agents should also review the state’s fair housing resources and notices via the Department of State (NY DOS). Embedding these references in your brokerage handbook—and linking to them inside RLTRsync’s resource section—keeps everyone aligned.

Real Estate Disclosure Automation vs. “We’ll Remember Next Time”

Memory is not a system. Teams change, weekends get busy, and human error is inevitable. Real estate disclosure automation hard-codes the right steps, removes ambiguity, and protects every agent equally. When questions surface months later, the difference between “I think I handed that out” and “Here’s the timestamp and acknowledgement” is the difference between risk and resolution.

Implementation Checklist (From First Open House to Brokerage-Wide)

First, define your required disclosures by state and brokerage policy. Second, load broker-approved templates and assign them to event types in RLTRsync. Third, test the visitor flow on a tablet or iPad at a sample property and confirm acknowledgements are stored. Fourth, enable alerts for missing steps so managers can intervene. Fifth, train agents with a 15-minute walk-through and a sandbox open house. In practice, teams go from zero to full real estate disclosure automation in a day.

Data Security, Privacy, and Document Retention

Compliance proof is only as strong as its storage. RLTRsync encrypts data in transit and at rest, separates production secrets, and offers role-based access so only authorized staff can view records. Establish retention policies that align with your legal counsel’s guidance and ensure your real estate disclosure automation system can export records on demand for audits or litigation holds.

Measuring ROI: Compliance Won’t Cost You Deals—It Saves Them

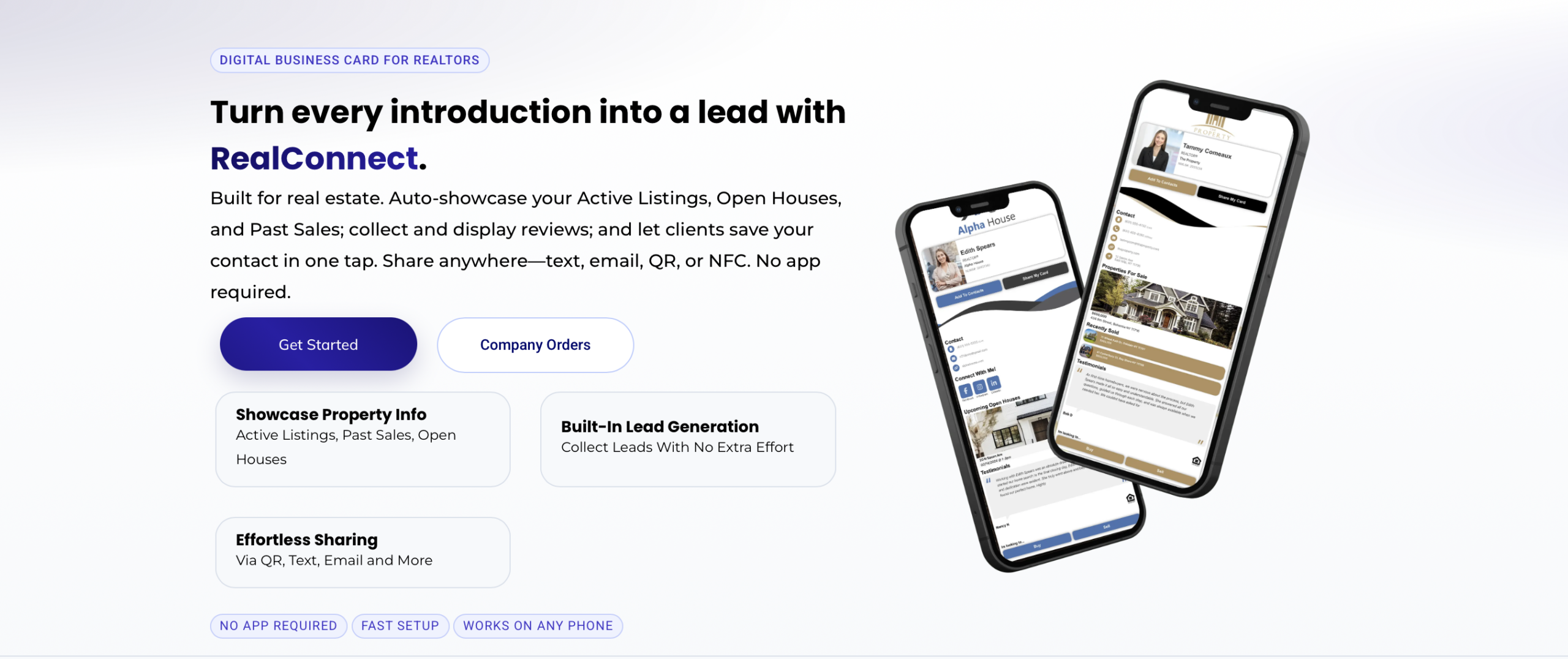

Automation recovers hours otherwise spent chasing signatures and searching email. More importantly, it reduces deal risk. When a buyer or attorney asks for proof, you deliver it in seconds. Pair that with RLTRsync’s lead capture and nurture tools—see our digital business card for Realtors—and compliance becomes a trust signal that wins listings and referrals.

Common Edge Cases (And How Automation Handles Them)

Multiple attendees sharing one device: Require each visitor to acknowledge disclosures individually. The system logs each person separately.

No-signal properties: Use local caching and sync when back online so real estate disclosure automation still records acknowledgements.

Language accessibility: Provide approved translations and record which version a visitor viewed, preserving clarity and intent.

Co-hosted events: Assign disclosures to the event, not just the agent, ensuring continuity if staff change mid-day.

Brokerage Governance and Standard Operating Procedures

Document who approves templates, who updates them, and how changes are communicated. In RLTRsync, lock templates at the admin level and require a changelog entry for edits. Quarterly audits—exporting a random sample of events and their disclosure logs—validate your real estate disclosure automation is functioning as designed.

Your Next Step: Launch Real Estate Disclosure Automation with RLTRsync

Agents shouldn’t have to choose between speed and safety. With RLTRsync, real estate disclosure automation happens behind the scenes at every open house, while your team focuses on conversations and follow-up. Set up a demo, load your templates, and run your next event with confidence.

FAQ

How fast can we implement? Most teams configure templates, test the flow, and run their first automated event the same day.

What about updates when laws change? Update the broker-approved template once; events immediately use the latest version while preserving historical records.

Does this integrate with lead capture? Yes. RLTRsync unifies sign-in, real estate disclosure automation, and lead capture, so compliance never slows growth.

Can managers monitor compliance? Admin dashboards show event-level completion and trigger alerts for missing steps.

How do we prove compliance later? Export the report: visitor, property, disclosure versions, timestamps, and acknowledgements—all in one file.

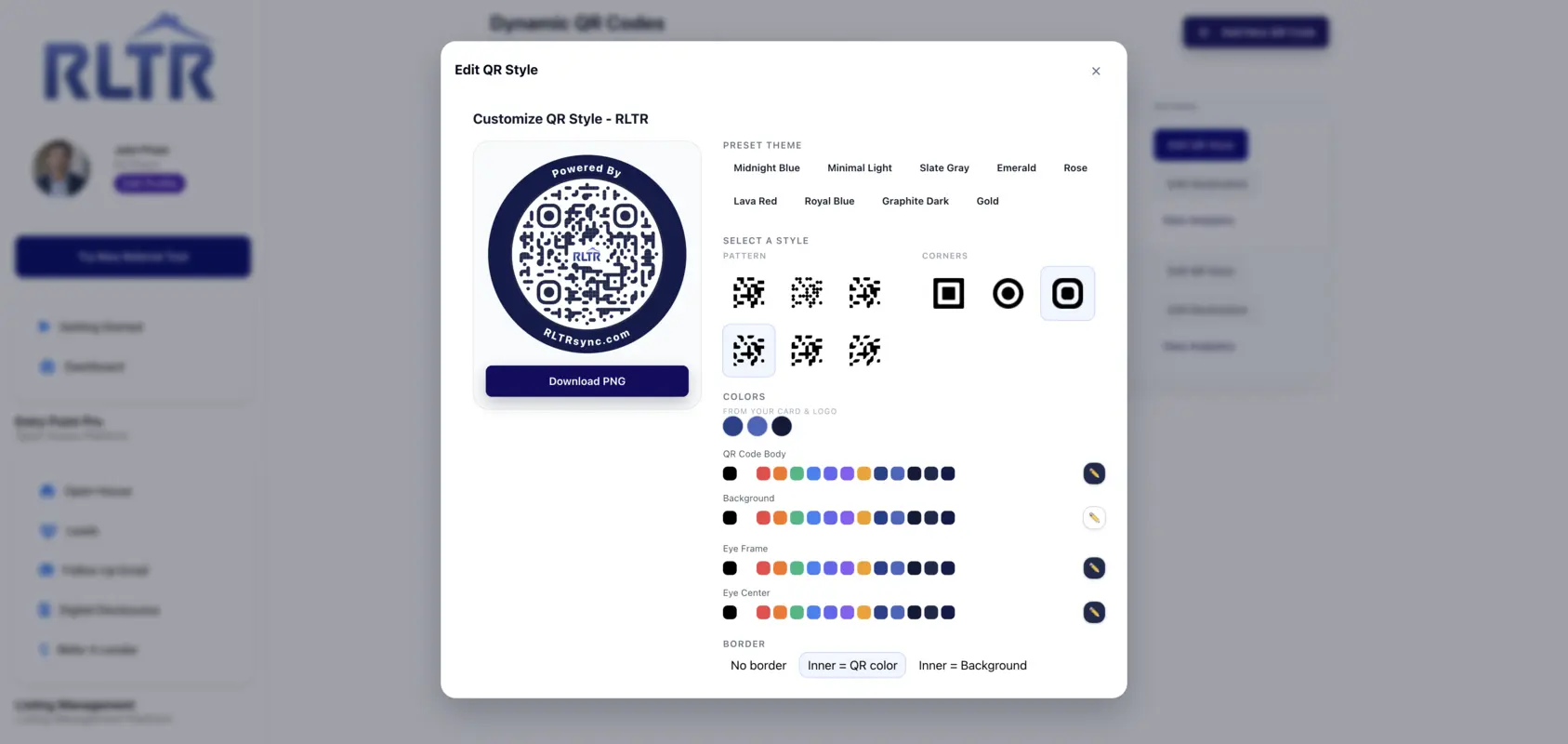

Icon On The Top Right Is the Menu For Your Card. This Is Where You can edit your card and log into your dashboard.

Icon On The Top Right Is the Menu For Your Card. This Is Where You can edit your card and log into your dashboard.